Company Provides Q4 2022 & Q1 2023 Production Estimate

VANCOUVER, BC / ACCESSWIRE / October 18, 2022 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce the recommencement of mining at the Company's 100% owned Valenciana Mines Complex ("VMC"), in Guanajuato, Mexico. Furthermore, the Company confirms that the planned restart of milling operations at the Cata processing facility is ahead of schedule and is expected to begin before year end.

Highlights:

- Mining of mineralized material has begun at the Valenciana Mines Complex ("VMC"); thus all of the mining assets acquired August 4 2022 - Topia, San Ignacio and VMC - are now in production (See GSilver news release dated August 4, 2022 - GSilver Closes Acquisition of Great Panther Mining Assets).

- The timetable for the restart of the Cata mill has been moved forward from early 2023 to Q4, 2022.

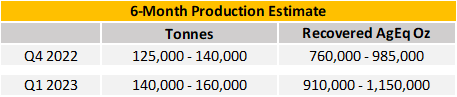

- The Company anticipates ending the year at a production run rate of approximately 3.4M AgEq ounces per annum; a more detailed Q4 2022 and Q1 2023 production estimate is outlined below.

James Anderson, Chairman and CEO said, "With the recommencement of mining at Valenciana, we have successfully revitalized another past producing silver mine within the Guanajuato Mining Camp where collectively more than 1.5 billion ounces of silver have been produced to date. We are extremely proud to be the owners and operators of this significant silver mine, and we are confident Valenciana will prove increasingly accretive for our shareholders."

Restarting Valenciana:

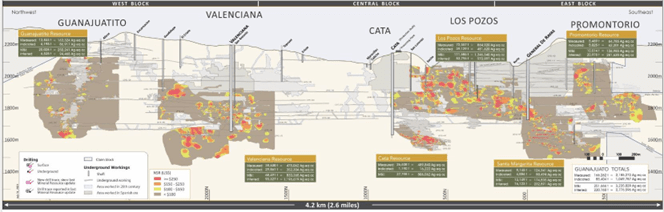

Cut & fill mining of high-grade epithermal veins at Valenciana is currently focused on the Los Pozos mine area where several mineralized blocks had been previously defined. Los Pozos is one of several mines that extend over 4.2km of the Veta Madre regional fault system at the VMC and sits between the Cata and the Rayas shafts (see Figure 1 below). Mineralized material from Valenciana is currently being transported to El Cubo for processing; the Company expects to mine 5,000 tonnes per month at Valenciana throughout the remainder of 2022.

Cata Mill Restart Imminent:

The Cata processing facility is centrally located within the Valenciana Mines Complex and has a production capacity of 36,000 tonnes per month. In November 2021 Cata was placed on care & maintenance by its previous owner. GSilver had initially anticipated restarting the Cata mill in 2023, but with the rapid recommencement of mining at San Ignacio and the VMC, the Company now expects to restart mineral processing at Cata before the end of 2022. The Cata facility comprises three ball mills and uses a two-crusher system; once in operation, Cata is expected to produce a silver-gold concentrate like that which is currently being produced at El Cubo. The Cata processing facility is in good condition and requires no significant additional capital expenditures prior to restart.

Figure 1: Valenciana Mines Complex Longitudinal View

Cautionary Note: Figure 1 has been extracted from the corporate presentation of Great Panther Mining Limited ("GPML") titled "GMC Mineral Resource Estimate Review, January 2022" (effective date July 31, 2021). GPML is the previous owner of the Valenciana Mine Complex (referred to by GPML as the Guanajuato Mine Complex or GMC) and all of the resource estimates included in Figure 1 are historical in nature. GSilver is not treating these estimates as current mineral resources as a qualified person on behalf of GSilver has not done sufficient work to classify these estimates as current mineral resources.i

GSilver Provides Preliminary Fourth Quarter 2022 and First Quarter 2023 Production Estimate*:

The Company anticipates ending 2022 at a combined production run rate of approximately 3.4M AgEq ounces per annum. Production ramp-up is expected to continue at all operations through Q1, 2023.

*This production estimate is based on the Company's estimate of current mineral resources and quantities of mineralized material at its mining projects. At present, the Company does not have any mineral reserves as defined in National Instrument 43-101. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues.

Technical Information

Reynaldo Rivera, VP of Exploration of GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM - Registration Number 220979) and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines near the city of Guanajuato, Mexico, which has an established 480-year mining history. With five mines and three processing facilities, the Company is one of the fastest growing silver producers in Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E:

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, the current and projected mined output from the Company's existing El Cubo and El Pinguico mines and newly acquired San Ignacio, Valenciana and Topia mines, and GSilver's anticipated performance for the balance of 2022 and first quarter of 2023, the ability of the Company to continue to increase production, tonnage and recoveries of mineralized material at El Cubo and El Pinguico in accordance with its objectives and timetable and to mirror such performance at San Ignacio, Valenciana and Topia; the ability of the Company to increase silver and gold grades, improve metallurgical recovery rates, increase revenues, and reduce production costs (including AISC) consistent with the Company's expectations and production model, the ability of the Company to ramp-up production from the San Ignacio and Valenciana mines, restart the Cata processing plant, and improve efficiency and output at the Topia mine as currently planned and the timing and costs thereof, the Company's future development and production activities; estimates of mineral resources and mineralized material at the Company's mining projects and the accessibility, attractiveness, mineral content and metallurgical characteristics thereof; the opportunities for future exploration, development and production at the Company's mines and the proposed exploration, development and production programs therefor and the timing and costs thereof; and the success related to any future exploration, development and/or production programs.

Such forward-looking statements and information reflect management's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our mineral resource estimates at El Cubo and El Pinguico and estimates of mineralized material at San Ignacio, Valenciana and Topia and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; the ability of the Company to successfully integrate production from San Ignacio and Valenciana into the Company's existing mining and milling operations at El Cubo and the availability of excess processing and tailings capacity at El Cubo to accommodate same; the ability of the Company to re-start milling operations at its newly acquired Cata plant to process mineralized material in the tonnage, throughput, timing and costs currently contemplated, the Company's ability to secure additional sources of mineralized material for processing, prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, currency rate fluctuations, rising inflation and interest rates, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at its mineral properties to process existing resources and mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, El Pinguico and its newly acquired San Ignacio, Valenciana and Topia mines is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected production of silver, gold and other metals will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the continued spread and severity of COVID-19, the ongoing war in Ukraine and rising inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company's interim financial statements and accompanying MD&A for the three and six month periods ended June 30, 2022. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

iThe resource estimates in Figure 1 were prepared by GPML using the definitions of "Mineral Resource" set forth in the CIM Definition Standards, adopted May 10, 2014, by the Canadian Institute of Mining, Metallurgy and Petroleum, and are historical in nature. GSilver is not treating these estimates, or any part thereof, as current mineral resources under NI 43-101 as a "qualified person" on behalf of GSilver has not done sufficient work to classify these estimates as current mineral resources. A thorough review by GSilver's "qualified person" of all historic data, the key assumptions, parameters, and methods used to prepare such estimates and additional exploration and validation work to confirm results, estimation procedures, and the standards by which the estimates were completed and/or categorized would be required in order to produce current mineral resource estimates for the Valenciana Mine Complex. For these reasons, among others, the historical estimates in Figure 1 should not be relied upon as a guarantee of mineral resources. Actual mineral resources, if any, may differ significantly. The historical estimates have been included in this news release to demonstrate the mineral potential of the mines within the Valenciana Mine Complex and as a guide to future mining and exploration activities.

SOURCE: Guanajuato Silver Company Ltd.

View source version on accesswire.com:

https://www.accesswire.com/720791/Guanajuato-Silver-Recommences-Mining-at-Valenciana-Mines-Complex