GSilver Furthers Consolidation of the Guanajuato Mining District

VANCOUVER, BC / ACCESSWIRE / August 4, 2022 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce that it has closed the purchase of Great Panther Mining Ltd.'s ("Great Panther") (TSX:GPR) Mexican subsidiary Minera Mexicana Rosario S.A. de C.V. ("MMR"), which owns the currently operating Topia mine and production facility in the state of Durango, Mexico ("Topia"), and the San Ignacio mine, the Valenciana Mine Complex ("VMC"), and the Cata processing plant in Guanajuato, Mexico (the "MMR Acquisition"), first announced in the Company's news release of June 29, 2022.

Highlights:

- GSilver expands to five mines and three production facilities.

- Production from San Ignacio expected to restart within 90 days

- Continued production from the Topia Mine anticipated to exceed 1.1 million AgEq ounces this year.

Closing the MMR Acquisition

GSilver and Great Panther closed the MMR Acquisition on August 4, 2022 with the execution of customary closing documents in Mexico and Canada and with the payment to Great Panther of US$14,700,000, subject to certain closing adjustments, satisfied with US$8,000,000 in cash and the delivery to Great Panther of 25,787,200 common shares of the Company.

Chairman and CEO James Anderson commented, "We look forward to integrating our new assets with current operations expeditiously. GSilver plans to restart the San Ignacio mine as soon as practicable, and deliver its silver and gold mineralized material to our El Cubo plant for processing. In the months ahead, we plan to do the same at the Valenciana Mine Complex - shipping mineralized material to El Cubo for processing - prior to re-starting the Cata mill in 2023. Meanwhile, at Topia, our other new asset, work will begin immediately to assess optimization opportunities to existing operations in both the mine and the plant."

MMR Assets Purchased:

Valenciana-Cata:

Great Panther referred to its five mines near the centre of Guanajuato as the "Guanajuato Mine Complex" or "GMC". From north to south, these mines are called Guanajuatito, Valenciana, Cata, Los Pozos, and Promontorio. Henceforth, GSilver will refer to these mines collectively as the "Valenciana Mine Complex" and to the accompanying processing plant, which has a nameplate capacity of 1,200 tonnes per day, as "Cata".

VMC has been in near continuous operation since the 1500s and is situated along the highly productive Veta Madre (‘Mother Vein'), encompassing a strike length of 4.2km. Valenciana became one of the premier silver mines in the world and, for a time, accounted for up to one-third of global annual silver production.

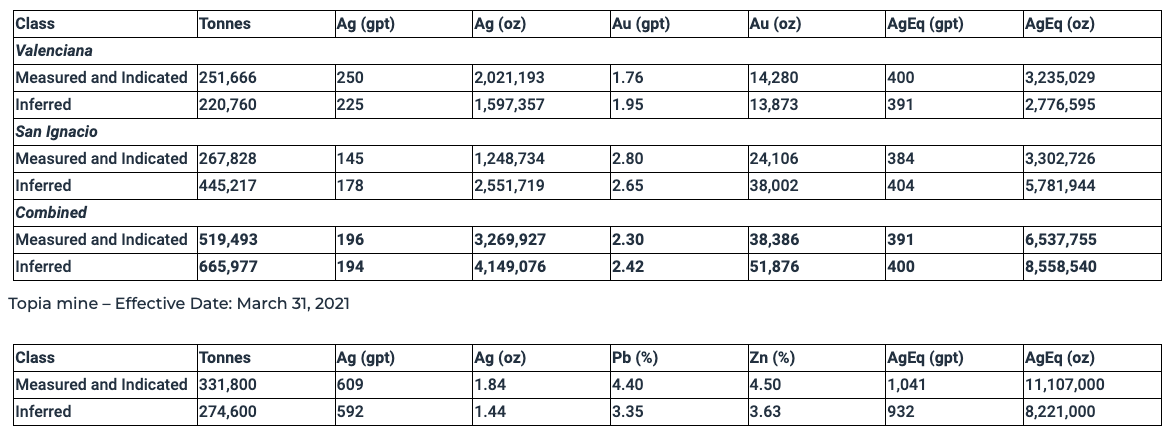

Historical in-situ measured and indicated resources at the Valenciana Mine Complex, as reported by Great Panther (effective date: July 31, 2021), totalled 251,666 tonnes grading 250 gpt Ag and 1.76 gpt Au (400 gpt AgEq) for 3.23M AgEq ounces, with additional inferred resources of 220,760 tonnes grading 225 gpt Ag and 1.95 gpt Au (391 gpt AgEq) for 2.77M AgEq ounces. See the mineral resources table for Valenciana below. (1)

The Cata processing plant, which forms part of the Valenciana Mine Complex, has a nameplate capacity of 1,200 tonnes per day (36,000 tonnes/month) and remains in good working condition. The plant is a traditional crushing, grinding and floatation system that produces a high-grade silver-gold concentrate.

Valenciana was put on care and maintenance by Great Panther in November 2021 because of a lack of tailings capacity.

San Ignacio:

The San Ignacio Mine is located approximately 20km by road west of the city of Guanajuato and 38km from GSilver's El Cubo mill. Mineralization exists within an epithermal quartz vein system called ‘La Luz', which is a large regional tectonic structure that also hosts Endeavour Silver's Bolanitos Mine.

San Ignacio has operated for 10 years, with high grade silver and gold material continually trucked to Great Panther's Cata mill for processing. GSilver intends to transport material from San Ignacio to El Cubo for processing.

Historical in-situ measured and indicated resources at San Ignacio as reported by Great Panther (effective date: July 31, 2021) totalled 267,828 tonnes grading 145 gpt Ag and 2.80 gpt Au (384 gpt AgEq) for 3.30M AgEq ounces, with inferred resources of 445,217 tonnes grading 178 gpt Ag and 2.65 gpt Au (404 gpt AgEq) for 5.78M AgEq ounces. See the mineral resources table for San Ignacio below. (1)

San Ignacio was put on care and maintenance by Great Panther in January 2022 due to a lack of tailings capacity.

Topia Mine and Mill, Durango, Mexico:

Great Panther has operated the Topia Mine in north-eastern Durango since 2004; the mine includes a 260 tonnes per day flotation processing plant that is currently operating at close to full capacity. The mineral deposits at Topia are different than those seen at Valenciana and San Ignacio, which exclusively produce precious metals. Mineralization at Topia exists as polymetallic epithermal veins that contain high-grade concentrations of silver, zinc, lead and gold. The Topia veins consist mainly of massive galena, sphalerite, and tetrahedrite in a gangue of quartz, barite, and calcite.

Historical in-situ measured and indicated resources at Topia as reported by Great Panther (effective date: March 31, 2021) totalled 331,800 tonnes grading 609 gpt Ag, 1.84 gpt Au, 4.4% Pb and 4.5% Zn (1,041 gpt AgEq) for 11.10M AgEq ounces, with inferred resources of 274,600 tonnes grading 592 gpt Ag, 1.44 gpt Au, 3.35% Pb and 3.63%Zn (932 gpt AgEq) for 8.22M AgEq ounces. See the mineral resources table for Topia below. (1)

Topia is currently in operation; the mine produces a lead-silver-gold concentrate and a separate zinc concentrate.

Valenciana and San Ignacio - Effective Date: July 31, 2021

|

Class |

Tonnes |

Ag (gpt) |

Ag (oz) |

Au (gpt) |

Au (oz) |

AgEq (gpt) |

AgEq (oz) |

|

Valenciana |

|||||||

|

Measured and Indicated |

251,666 |

250 |

2,021,193 |

1.76 |

14,280 |

400 |

3,235,029 |

|

Inferred |

220,760 |

225 |

1,597,357 |

1.95 |

13,873 |

391 |

2,776,595 |

|

San Ignacio |

|||||||

|

Measured and Indicated |

267,828 |

145 |

1,248,734 |

2.80 |

24,106 |

384 |

3,302,726 |

|

Inferred |

445,217 |

178 |

2,551,719 |

2.65 |

38,002 |

404 |

5,781,944 |

|

Combined |

|||||||

|

Measured and Indicated |

519,493 |

196 |

3,269,927 |

2.30 |

38,386 |

391 |

6,537,755 |

|

Inferred |

665,977 |

194 |

4,149,076 |

2.42 |

51,876 |

400 |

8,558,540 |

Topia mine - Effective Date: March 31, 2021

|

Class |

Tonnes |

Ag (gpt) |

Ag (oz) |

Pb (%) |

Zn (%) |

AgEq (gpt) |

AgEq (oz) |

|

Measured and Indicated |

331,800 |

609 |

1.84 |

4.40 |

4.50 |

1,041 |

11,107,000 |

|

Inferred |

274,600 |

592 |

1.44 |

3.35 |

3.63 |

932 |

8,221,000 |

Closing the MMR Acquisition - Details:

On closing of the MMR Acquisition today, GSilver paid US$14.7M to Great Panther as follows:

- US$8.0M in cash.

- US$6.7M in GSilver common shares at a deemed price of C$0.335 per share, for a total of 25,787,200 GSilver shares (the "Consideration Shares"). The Consideration Shares are subject to a statutory hold period of four months and one day expiring December 5, 2022. In addition, 6,446,800 or 25% of the Consideration Shares are subject to an 8-month voluntary hold period expiring April 4, 2023 and a further 6,446,800 or 25% of the Consideration Shares are subject to 12 month voluntary hold period expiring August 4, 2023.

GSilver also paid US$1.35M in working capital adjustments (subject to post-closing reconciliations) to Great Panther for excess working capital left in MMR over and above the agreed upon target working capital. Total acquired working capital includes US$500K in cash.

GSilver has also agreed to pay Great Panther up to an additional US$2.0M in contingent payments based on the following:

- US$500,000 upon GSilver producing 2,500,000 ounces of silver from the purchased MMR assets.

- US$750,000 if the price of silver closes at or above US$27.50 per ounce for 30 consecutive days within two years after closing.

- US$750,000 if the price of silver closes at or above US$30.00 per ounce for 30 consecutive days within three years after closing.

Hernan Dorado Smith, a director of GSilver and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

About Guanajuato Silver Company Ltd.:

GSilver mines and processes silver and gold concentrate from its El Cubo, Valenciana, San Ignacio and Pinguico mines in Guanajuato, Mexico and from its Topia mine in Durango, Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Communications Manager, +1 (604) 723-1433

Email:

Continue to watch our progress at: www.GSilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information and Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, the ability of GSilver to re-start mining operations at San Ignacio and Valenciana and truck mineralized material to El Cubo for processing in the capacity and on the timetable presently contemplated, the estimated production at Topia for 2022 and the ability of GSilver to improve the efficiency of mining operations thereat, the ability and timetable for GSilver to re-start processing of mineralized material at the Cata processing plant, the potential mineral resources at San Ignacio, Valenciana and Topia, and the ability of GSilver to successfully integrate San Ignacio, Valenciana and Topia into its current mining operations as planned and in accordance with its proposed timeline. Such forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected including, but not limited to, market conditions, availability of financing, metals prices, currency rate fluctuations, actual results of exploration, development and production activities including processing capacity, production rates and metal grades, unanticipated geological formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, delays in obtaining governmental or regulatory approvals and permits, and other risks in the mining industry. There are no assurances that GSilver will successfully integrate MMR's mining properties into its current operations as presently contemplated or at all. In addition, there is continued uncertainty surrounding the spread and severity of COVID-19, the ongoing war in Ukraine, rising inflation and interest rates (domestically and abroad) and the impact they will have on the Company's operations, supply chains, ability to access the MMR properties, El Cubo and/or El Pinguico or procure equipment, contractors and other personnel or raise capital on a timely basis or at all and economic activity in general. All the forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com and readers should not place undue reliance thereon. The forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

- These estimates have been extracted from the following National Instrument 43-101 technical reports filed by Great Panther under its profile on SEDAR at www.sedar.com and use the definitions of "Mineral Resource" set forth in the CIM Definition Standards, adopted May 10, 2014, by the Canadian Institute of Mining, Metallurgy and Petroleum:

- NI 43-101 report on the Guanajuato Mine Complex dated February 28, 2022 (effective date July 31, 2021) prepared on behalf of Great Panther by Robert F. Brown, P. Eng, and Mohammad Nourpour, P. Geo., (together the "GP Qualified Persons") and titled "NI 43-101 Mineral Resource Update Technical Report on the Guanajuato Mine Complex, Guanajuato and San Ignacio Operations, Guanajuato State, Mexico" (the "Guanajuato Report"); and

- NI 43-101 report on the Topia Mine dated February 11, 2022 (effective date March 31, 2021) prepared on behalf of Great Panther by the GP Qualified Persons and titled "NI 43-101 Report on the Topia Mine Mineral Resource Estimates as of March 31, 2021" (the "Topia Report"),

Such estimates are subject to certain assumptions regarding grade, metal prices, currency exchange rates, costs, metals production rates, schedule of development, labour, consumables and other material costs, markets and market prices as more particularly set out in the reports. AgEq oz were calculated using 85:1 Ag:Au ratio. AgEq gpt and AgEq oz figures reported for Topia have been extracted from Great Panther's news release dated February 11, 2022.

The Guanajuato resources were estimated from six area-specific block models at Guanajuato, and eighteen block models at San Ignacio. A set of 44 wireframes representing the mineralized zones served to constrain the block models and data subsequently used in Inverse Distance Cubed (ID3) Au and Ag grade interpolation. The geological interpretation was provided by Great Panther. Wireframe modelling was completed using MICROMINE and Leapfrog 3D geological modelling software and grade estimation and geological modelling completed using by MICROMINE software. See the Guanajuato Report for further details of the key assumptions, parameters, and methods used to prepare the resource estimate.

The Topia resources were estimated from 10 mine area-specific block models. A set of 60 wireframes representing the mineralized zones (veins) served to constrain both the block models and data subsequently used in Inverse Distance Cubed (ID3) gold, silver, lead, and zinc grade interpolations. Each block residing at least partly within one of 60 wireframes received a grade estimate. The full operational cost cut-off value as calculated by Great Panther's mine operating staff ranges from US$202 to US$345/tonne for different areas based on full mine operating costs (mining, milling, administration). Block model silver, gold, lead, and zinc grades have been converted to an US$ NSR value using an NSR "calculator" which takes into effect metal prices (long term projected to be US$20.00/oz silver, US$1,650/oz gold, US$0.85/lb lead, and US$1.20/lb zinc), plant metallurgical recoveries of 92.4% for Ag, 55.4% for Au, 94.3% for Pb, and 90.5% for Zn, concentrate shipping charges, and proprietary smelter terms. Blocks with an NSR value equal to or greater than the operations full cut-off costs were tabulated into the mineral resource estimate for each zone. The cut-off value was applied to each block estimated in the resource block model. Mineral Resource blocks are only considered Measured or Indicated if they are within 10m or 20m of underground channel sampling associated with mine development. See the Topia Report for further details of the key assumptions, parameters, and methods use to prepare the resource estimate.

GSilver is not treating these estimates as current mineral resources as a "qualified person" on behalf of GSilver has not done sufficient work to classify the estimates as current mineral resources and therefore such estimates should not be relied upon. A thorough review by GSilver's "qualified person" of all historic data, along with additional exploration and validation work to confirm results and estimation parameters, would be required in order to produce a current mineral resource estimate for the Valenciana and San Ignacio mines and Topia.

SOURCE: Guanajuato Silver Company Ltd.

View source version on accesswire.com:

https://www.accesswire.com/710928/GSilver-Closes-Acquisition-of-Great-Panthers-Mexican-Mining-Assets