Vancouver, BC, February 7, 2018, Vangold Mining Corporation ("Vangold" or the "Company") (TSXV:VAN)(OTC:VGLDF)(FR:E35B) is pleased to announce that it has initiated a Resource Valuation and Preliminary Economic Assessment (“PEA”) in respect of the Company’s 100% owned El Pinguico Project, in Guanajuato, Mexico. The PEA will provide a base‐case assessment for the further development of the existing mineral resource and the recommencement of mining operations utilizing current standing stock ore piles and mining infrastructure, including the existing shafts, adits and tunnels to a depth of 300 meters from surface. The objective of this study is to determine the potential economic viability of the current mineral resources at El Pinguico along with a level of cost indication sufficient to proceed to the next level of mine development and valuation. Completion of the PEA is expected in Q2 2018.

“The El Pinguico mine is a historic high‐grade producer, possessing in‐situ high‐grade silver and gold mineralization with accessible mining infrastructure to a depth of 300 meters. The completion of a base case development scenario will be a significant milestone in understanding the available economics of the stockpiles and cost related in new mine development”, said Cameron King, President and CEO of Vangold.

APEX Geoscience Ltd. (“AG”) and MinePlus Pty Ltd. (“MP”), based in Vancouver, BC have been contracted to work with the Company’s technical team on assay results and mineralization assessment for the PEA. The updated 43‐101 report will support the PEA and determine projected capital costs, operating costs, and project economics associated with the potential development of the El Pinguico mineral resource.

AG and MP will:

-

- Analyze and evaluate the economic, technical and geological factors that will determine the potential viability of the stockpile mineral.

- Establish the basis and strategy for the Phase 2 drilling on the in‐situ resources which encompasses:

- Lower extension of the El Pinguico vein, drilling into and underneath the old working of the El Carmen and El Pinguico mines;

- Calculate drilling depth for intersection of the Veta Madre and El Pinguico vein systems;

- Analyze geological data realized during the 2017 geological program to establish intersection of parallel veins San Jose and Pachuca;

- Analyze and understand the potential mineralization in the hanging wall and footwall of the Pinguico vein.

- Evaluate mineable tons from surface (“S”) and underground (“UG”) stockpiles.

- Determine mill economics and cut‐off grade based on grab samples and drilling assays from S and UG stockpiles for definitive mineral resource model and production plan.

- Design a new decline, ventilation infrastructure, tramming drive and draw points required to ensure the maximum efficiencies for a future production.

- Develop a production plan to maximize the mill capacity with a local mill with potential ore deliveries between 15,000 to 30,000 ton per month depending of the mill requirements.

- Review milling performance and metallurgical recovery based on existing mill records and the results of the metallurgical bulk sampling scheduled for the end of February.

- Propose a work program to continue advancing the project.

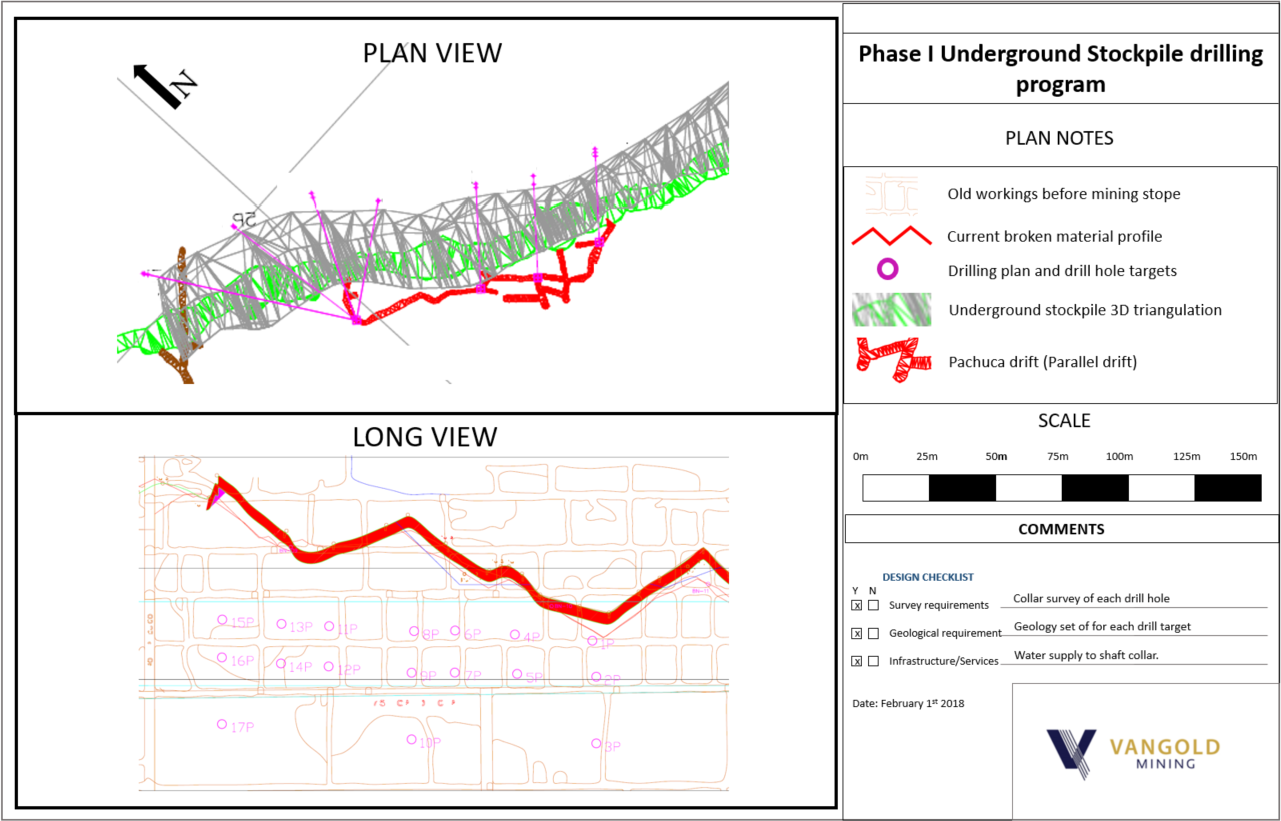

El Pinguico Phase 1 Drill Plan – UG Stockpile Resource Model

Phase 1 Drilling Update: Underground El Pinguico Mine

Drilling commenced in mid‐January 2018 on drill station No. 3 in the Pachuca adit, a parallel drift to the UG stock pile. The drilling rig has completed three of the planned 17‐hole drill plan. The three drill holes have intersected the UG stock pile with an average recovery of 70% of the entire drill hole and 43% recovery of the broken material in the stockpile, which is providing the samples required to perform the assay test and giving evidence of consistent sulphidation which indicates high potential Au and Ag content. Core samples from the first three drill holes will be sent to a local lab for assaying as soon as the Geological team finalizes the logging of the drillholes. Results from these first three holes are expected by the end of February. The Phase 1 drill plan is expected to be completed in mid‐March 2018 and core assay results will be disclosed in several stages throughout the course of the UG drill program.

Vangold is committed to a multiple Phase Drill Program over Q1 and Q2 2018. The assay results of the drill programs will form the basis of the Company’s updated 43‐101 Resource Valuation and PEA. These drill programs will provide valuable information as to the potential economics and the long‐term viability of the El Pinguico mine and Vangold’s surrounding properties San Carlos and Patito I & II.

About Vangold Mining Corp.

Vangold is a development‐stage silver and gold company with nine mining concessions in the Guanajuato, Mexico Mining District. Vangold is aggressively pursuing its production plans by bringing the historic El Pinguico mine back online. Having an acquisition focus, targeting advanced mineral properties and the pursuit of near production opportunities will continue to fuel our growth.

Qualified Person

Mr. Hernan Dorado, a director of Vangold Mining Corp. is a member of the Mining and Metallurgical Society of America and is a qualified person as defined in National Instrument 43‐101 and has reviewed and approved the technical contents of this news release.

ON BEHALF OF THE BOARD OF DIRECTORS

“Cameron S. King”

President, CEO and Director

For further information contact:

O: + 1‐778‐945‐2940

M: +1 604 499 6545

E:

Further information is available on Vangold Mining’s web site at: www.vangoldmining.com.

Cautionary Statement Regarding Forward Looking Information

This News Release may contain, in addition to historical information, forward‐looking statements. These forward‐looking statements are identified by their use of terms and phases such as “believe,” “expect,” “plan,” “anticipate” and similar expressions identifying forward‐looking statements. Investors should not rely on forward‐looking statements because they are subject to a variety of risks, uncertainties and other factors that could cause actual results to differ materially from Vangold's expectations, and expressly does not undertake any duty to update forward‐looking statements. These factors include, but are not limited to the following, limited operating history, proposed exploration and/or drill programs and other factors which may cause the actual results, performance or achievements of Vangold to be materially different from any future results, performance or achievements expressed or implied by such forward‐looking statements.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.